April 17, 2025

Office-to-multifamily conversions offer a pragmatic, dual-purpose solution to revitalizing commercial corridors and addressing the housing supply shortage. This comes at a time when nearly 20 percent of office buildings sit empty nationwide and the housing deficit of between 4.5 million and 7 million units is pushing home prices and rental costs to record highs. The need for creative solutions has never been more pressing.

While urban downtown office conversions have garnered the most attention, the suburbs offer fertile ground for these projects. A Moody's report finds that many suburban areas' office vacancy rates are higher than in the city centers, while Realtor.com notes that housing shortages there are often more acute.

A recent study leveraging data from the CBRE U.S. Office Research Team highlights this trend. Out of 873 office conversion projects nationally, researchers narrowed their focus to 43 suburban conversion cases, including 15 completed between 2016 and early 2024. The findings reveal some important distinctions and lessons.

Suburban conversions typically involve much newer buildings; the average was built in the early 1980s. The benefits of their younger age include modern HVAC systems, elevators, and more adaptable layouts, which can reduce the cost and complexity of retrofitting. On the downside, most don't qualify for Historic Preservation Tax Credits, an important tool for lowering costs.

Unlike urban adaptive reuse projects, which often repurpose older Class C buildings, suburban projects more frequently involve Class A and B properties with smaller average square footage. They often are located on high-value land, making their shift to residential a more intensified and efficient use of space, especially in growing markets. With convenient access to major transit hubs, highway networks, and employment centers, these projects cater to renters looking for modern amenities and high-quality living spaces. For developers, the suburbs also often offer more flexible zoning regulations than city centers.

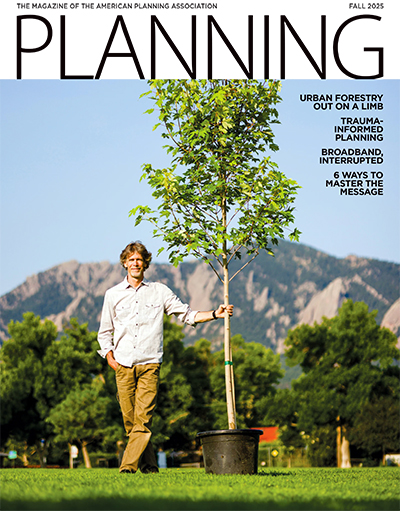

The suburbs are ripe for office-to-multifamily conversions like Springdale, Ohio's Row on Merchant, which added new townhomes around its retrofitted buildings. Photo courtesy of Newmark Real Estate of Ohio, LLC.

5 Lessons from Suburban Adaptive Reuse

While upscale conversions are common in states like Virginia and California, researchers also looked at projects in the Midwest and other regions. The Row on Merchant in Springdale, Ohio, outside Cincinnati, is one example. The property was a typical three-story office building in the heart of the city's largest office district, surrounded by large parking lots. In addition to 131 units in the two existing buildings, the developer razed the surface lots and built 97 townhomes.

In Falcon Heights, Minnesota, near Saint Paul, Amber Union adaptively reused a 1947 former Farmer's Union Grain Terminal Association headquarters. One of the largest and most successful farmer's cooperatives in the United States, today, it's a 125-unit attainable housing project.

Both of these focus on quality, modern amenities, and flexible lease options in proximity to employment centers, but they also encountered unexpected financial and political challenges, requiring innovative funding strategies and community engagement. The projects help demonstrate some of the lessons from the office-to-multifamily conversions study.

1. Look for financial incentives

Tax credits, subsidies, and preservation incentives can offset high renovation costs, especially for attainable housing projects. To be successful, projects such as these must include realistic financial projections and careful feasibility assessments.

The $51 million Amber Union faced some real funding hurdles, but overcame them by securing Historic Preservation Tax Credits, tax-exempt bonds, and tax-increment financing (TIF). The developers of Springdale's Row on Merchant, which received strong municipal support, saw their cost savings erode due to unforeseen infrastructure and design issues that only became apparent after the project had begun, despite extensive due diligence.

The design of Amber Union's interior spaces, like this common area for receiving mail and packages, honors the Art Deco style of the historic building. Photo by Spacecrafting/Mohagen Hansen Architecture | Interiors.

2. Get flexible and streamline

Cities might need to adapt zoning codes to support office-to-multifamily conversions and expedite permitting approval processes. The article "Zoning for Office-to-Housing Conversions" in Zoning Practice notes that zoning standards can exempt adaptive reuse projects from certain site development rules, like reducing or eliminating parking requirements.

3. Be strategic about site selection

Not all office buildings are suitable for conversion, and projects in walkable, transit-accessible areas are more likely to succeed. Only 25 percent of the office buildings (in any location) are suitable candidates for conversion, according to a 2023 study by Gensler. "Context, building form, location, floor plate size, and several other factors all play a crucial role in assessing a building's aptness for conversion," the study notes.

4. Engage the community

Addressing local concerns early through public consultations and impact studies can reduce opposition and improve project acceptance.

While there was little initial opposition, locals' attitudes toward Amber Union shifted as issues related to traffic congestion, parking, and property values emerged. Falcon Heights' Community Development Coordinator Hannah Lynch emphasizes that planners should consider the long-term impact on community sentiment. "As the housing filled up, attitudes toward future developments were shaped by operational challenges and community reception," she says. The experience underscores the need for proactive engagement with local stakeholders to mitigate resistance and foster support.

5. Monitor long-term performance

Evaluating post-occupancy outcomes can help policymakers refine incentives and regulations to encourage broader adoption.

Beyond expanding housing supply and revitalizing underused spaces, this approach may offer additional benefits such as enhancing sustainability by being more energy-efficient and less resource-intensive than new construction and improving livability by potentially fostering walkable, mixed-use developments that reduce commute times. However, the path forward is not without obstacles. Structural limitations, high renovation costs, complex regulatory requirements, and community opposition, often fueled by NIMBY sentiment, pose significant hurdles that must be navigated to unlock the full potential of these conversions.

As work and housing dynamics continue to evolve across the U.S., the suburban office-to-multifamily conversion trend is poised to remain a valuable strategy in tackling commercial vacancies and housing shortages, helping to shape more resilient, dynamic, and livable communities in the process.