Uncovering JAPA

How Cities Can Plan For Persistent Remote Work

By December 2021, 99 percent of United States schools were open for in-person instruction, and sporting events were operating at full capacity. But did the economy and society return to their pre-pandemic state?

In "Going Nowhere Faster: Did the COVID-19 Pandemic Accelerate the Trend Toward Staying Home?" (Journal of the American Planning Association, Vol. 91, No. 3), Eric A. Morris, Samuel Speroni, and Brian D. Taylor used ordinary least squares regressions to study changes in time spent before and after the pandemic across various out-of-home activities, daily travel, and in-home activities.

A Shift Toward Staying In

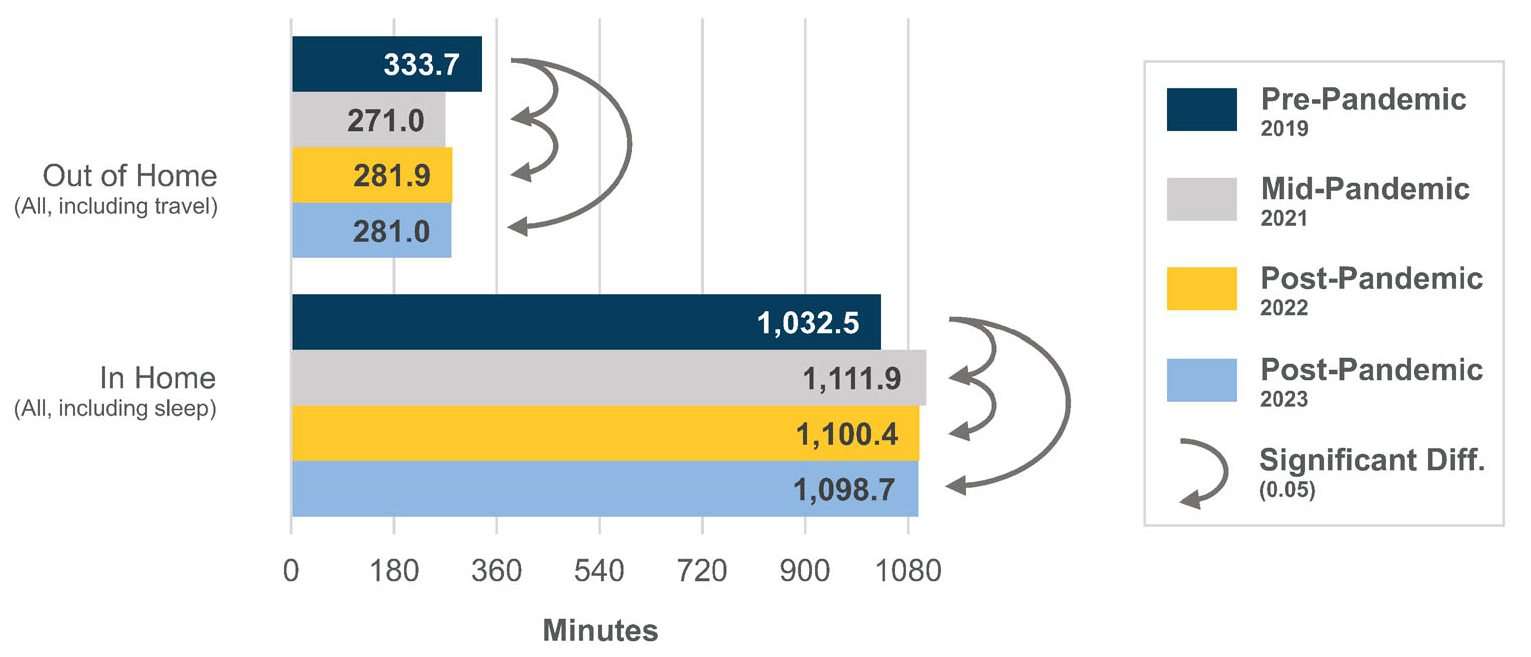

Comparing 2019 (the year before the pandemic) and 2021, the study found sharp declines in time spent on overall out-of-home activities and travel by all modes. At the same time, time spent on most in-home activities increased. These changes persisted through 2023.

Time spent out of the home, traveling by all modes except air, and engaging in six out-of-home activities remained significantly lower in 2023 than in 2019, while time spent on nine in-home activities remained higher. The trend away from out-of-home activities and travel appears to be continuing.

Figure 1: Time spent in-home and out-of-home (2019 and 2021-2023).

The Pandemic Amplifier

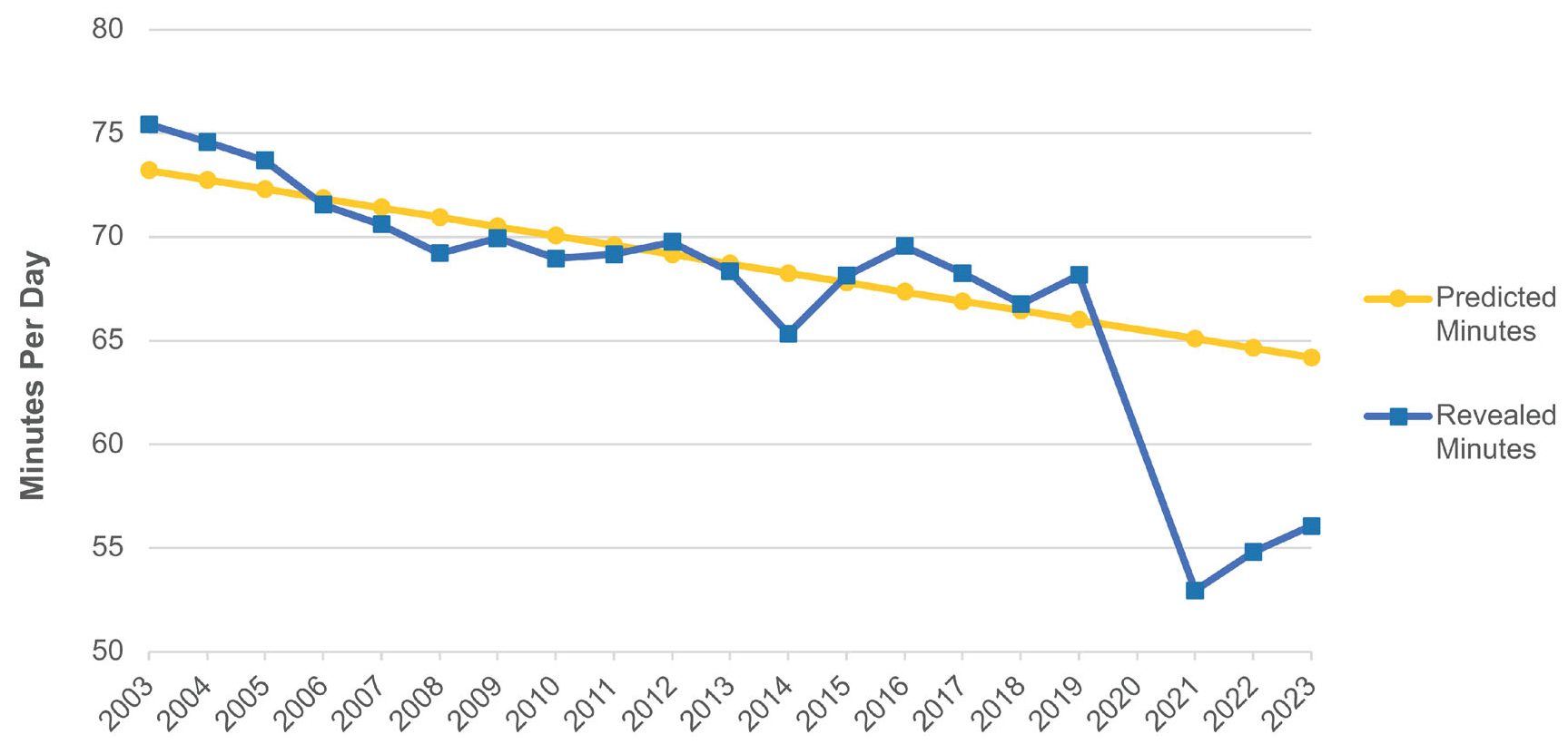

The trend toward relocating activities into the home preceded the pandemic by at least 16 years. The sudden and substantial decline in out-of-home activities during and after the pandemic strongly amplified prior trends but did not initiate them. Many factors may have contributed to the gradual pre-pandemic shifts and intensified the pandemic-era changes.

For example, online shopping contributed to the struggles of brick-and-mortar retail in malls, commercial strips, and downtown areas. Similarly, the shift away from out-of-home movies, theater, and sporting events toward in-home streaming video and video games weakened demand for commercial entertainment.

Figure 2: Predicted and revealed out-of-home time use (2003-2023) shows that travel time fell by 12 minutes instead of by 1 minute as was predicted.

Planning for a Home-Centered World

Across the U.S., particularly in the centers of the largest, densest, and wealthiest cities, business and political leaders are leading campaigns to return to the workplace. They view this as a means of stabilizing falling downtown commercial occupancy rates, rents, and retail real estate values, as well as sales and property tax revenues. At the same time, many workers clearly prefer working from home and are resisting a forced return to the office.

So far, the balance appears to favor the demands of at-home workers. This shift has substantial land use impacts. Increased remote work has contributed to reduced demand for office spaces and higher vacancy rates in metropolitan areas across the U.S. Conversely, housing demand has remained strong as people seek larger and more affordable homes, often in suburbs and lower-cost metro areas.

When cities can no longer rely on vast numbers of captive office workers to occupy office space and spend time and money downtown, they must work to attract residents, customers, and tourists. Local officials may seek to invest more heavily in their remaining urban strengths.

Many local governments strictly regulate and limit the conversion of office buildings to new uses. Planners may now seek to allow greater flexibility in this process and work with developers and architects to design and redesign office space for hybrid work.

Growing demand for housing that is both more spacious and affordable will require adjustments in planning for suburbs and exurbs of large metropolitan areas, as well as in smaller, more affordable metro areas. Fewer personal shopping trips and more home deliveries have the potential to reduce vehicle miles traveled. However, this shift raises planning challenges, such as the need to free up curb space for delivery vehicles.

KEY TAKEAWAYS

- Employers should consider repurposing some office and retail land uses.

- Center cities can capitalize on strengths beyond office space, such as recreational and residential amenities.

- Anticipate increased demand for more spacious and affordable housing.

- Expect a reduced need for costly interventions to expand highway and transportation systems.

Top image: Photo by iStock/Getty Images Plus/ NickyLloyd

ABOUT THE AUTHOR